In the first article of this series, we discussed the genesis of web & app-based trading platforms from the heady days of open outcry trading to the development of telecommunications and how the internet and mobile revolutions paved the way for modern trading platforms. We also provided a brief overview of why one needs to localise these platforms.

Now, we’ll take a look at what is prevalent in practice today and, with specific examples, we’ll explore how translation and localisation can help enhance these functional provisions for users of trading platforms. We’ll see what leading brokers around the world have on offer and how they’ve integrated their products with different markets globally to capture local clientele.

To begin with, let’s take a look at some of the factors that go into making a successful global trading platform:

- User-friendly & well-equipped platform

- Pocket-friendly fees and commission

- Access to markets & products – wider reach and higher product diversity

- Quick & hassle-free money transfer across currencies

While points 2, 3, and 4 above are largely a matter of an entity’s economic and business models and the reach it wants to have, extensive localisation and multilingual support are required to score high on point 1. Although there are several aspects that require the product to address a particular geographical market and be customised according to user needs, the users will only have a seamless experience and be able to enjoy the application’s full capability if it is well comprehended.

To begin with, having the product demo in a language that the target client base understands is a great start. Not only will it help keep the audience better engaged, but it will also reassure them that there is a platform they can understand and use. Interactive Brokers (IBKR), adjudged one of the best online trading platforms on multiple occasions does this successfully for its Chinese users with their mobile (iOS) trading platform demo video in Chinese. Not limiting it to the demo, the launch of their Shenzhen – Hong Kong Connect Program offered multilingual voice feedback with their IB Trader Workstation for all key actions.

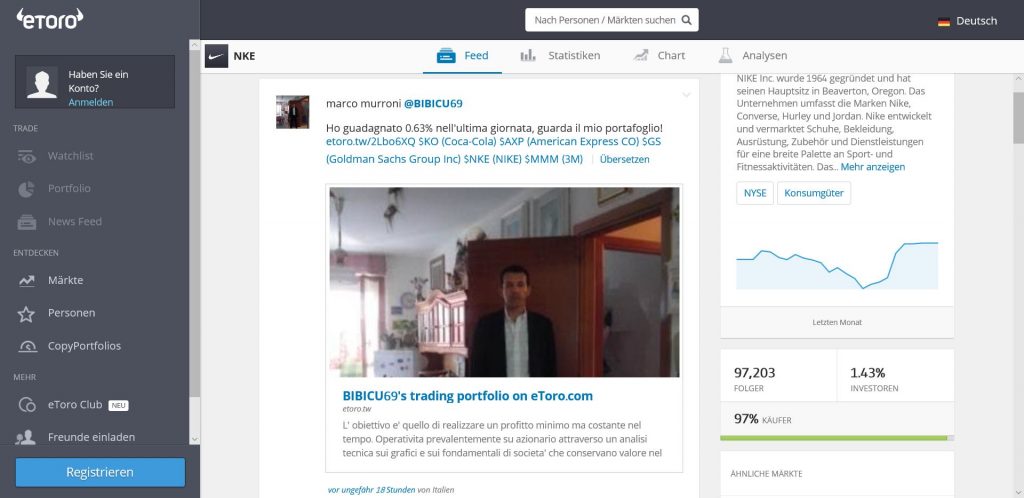

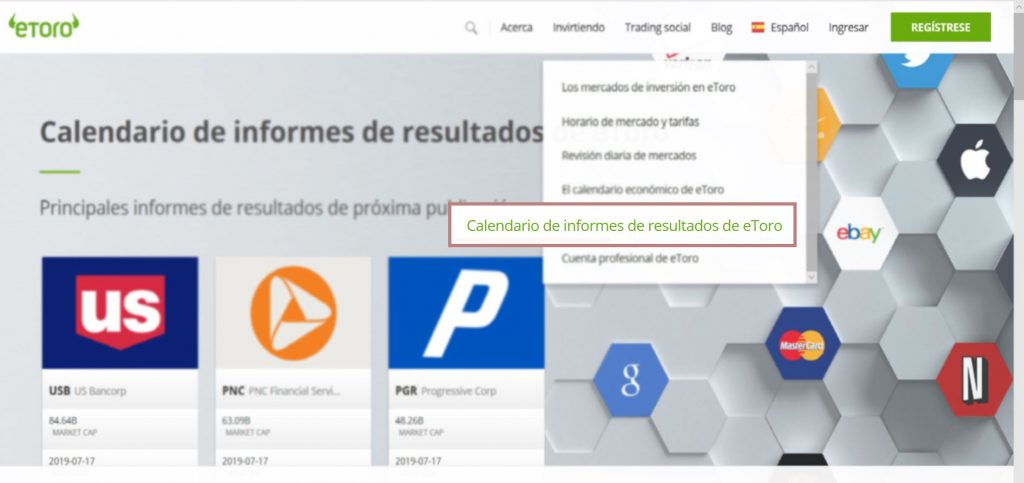

Moving onto the next level where providers are extensively using multilingual approaches to tap global audiences, eToro is a fantastic fintech example where one gets to see financial translation, localisation, and financial innovation come together to provide a unique solution to traders across geographies. Founded in Israel and headquartered across London, Limassol and Tel Aviv, eToro brings multi-asset social trading to its users focusing on copy trading. This enables traders to copy trades from other successful traders along with their own trades. Users can access their website in 21 languages and trade across stocks, currencies, and cryptocurrencies like Bitcoin, Ethereum, etc.

Due to its global approach, eToro has been able to quickly scale up operations to reach over 10 million accounts in just over a decade of its existence.

With the IBKR & eToro examples in mind, let’s now put into perspective what traders around the world are looking for in particular in these web-based and app-based online trading platforms and what helps brokers penetrate international markets. Here are a few features, in no specific order of importance:

Account Opening & Demo

More often than not, the first interaction a client has with their broker is either about getting to know the platform better before making the decision to open an account or when trying to open the account, going through the formalities. Therefore it is vital that both these processes leave the client or prospective client more than merely satisfied. Both require clear communication that combines diverse aspects like marketing, regulations, and legalities. All these need to be necessarily localised.

Legal agreements between a depository participant or broker and the client, information on charges, and how to best use the platform can be best understood in the client’s native language. Investing in top-notch financial translation services can turn out to be the real game-changer in successful market penetration.

Zerodha, one of the pioneers of discount broking in India, started operations in 2010 amid well-established online brokers and has swiftly taken the pole position as the top brokerage firm in India. Zerodha has over a million retail accounts accounting for 10% of all trade volumes on major Indian stock exchanges. A part of this success was due to them introducing multiple language support which tapped clients from diverse regions across the country that has as many as 23 official languages!

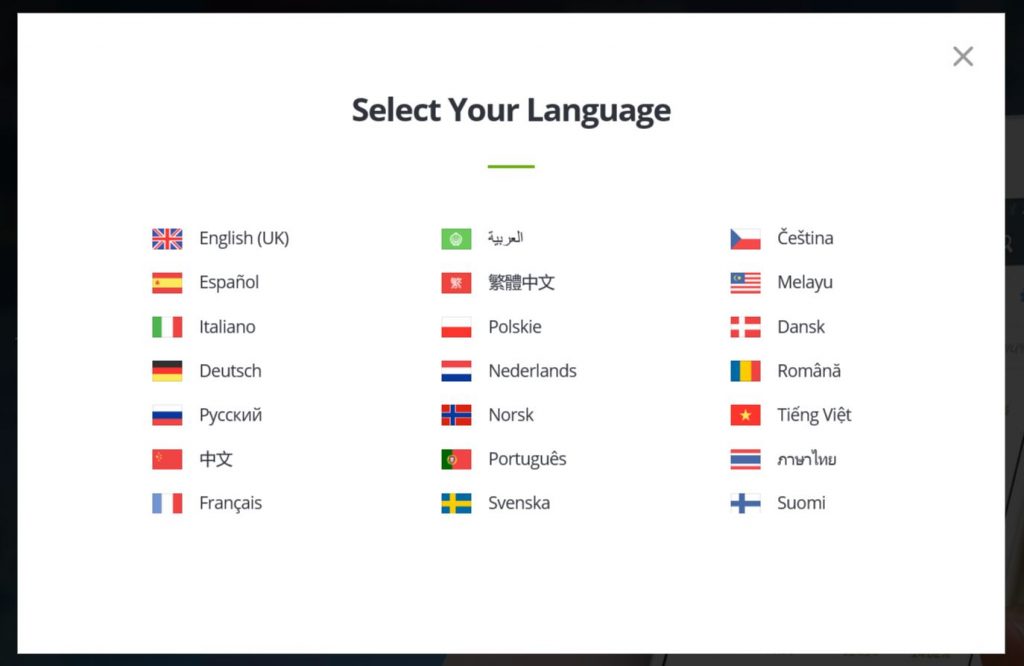

Another example is the MetaTrader 4 (MT4) trading platform. Developed by MetaQuotes Software Corp. in 2006, it is widely used by retail foreign exchange traders across the globe on computers as well as mobile devices. The image below illustrates how customers can view the interface in one of the 22 languages they offer for iOS devices.

The Trading Screen

The screen on a trader’s app where the trader can see all the holdings and open positions is called the portfolio screen and is often toggled with the watchlist screen or view where one can see the assets that are being tracked (observed). This, along with the trading screen or window forms the most used screens for traders. Most platforms combine the two by providing one-click access to a trade window when a particular security is clicked on, in the portfolio screen. Interactive Brokers’ showcase their portfolio screen in Italian in this video.

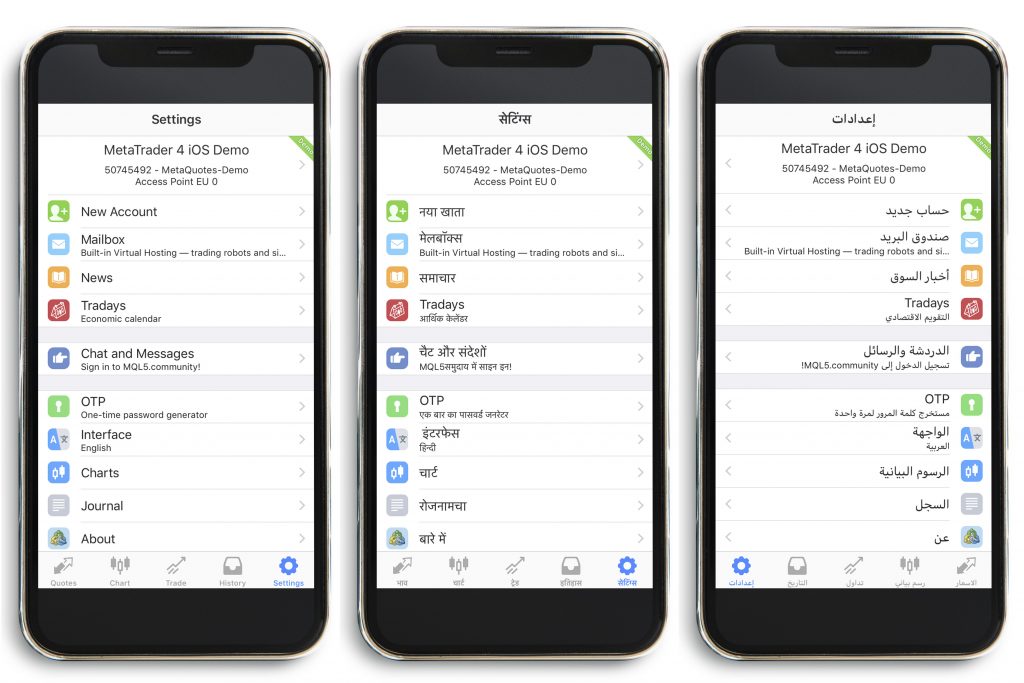

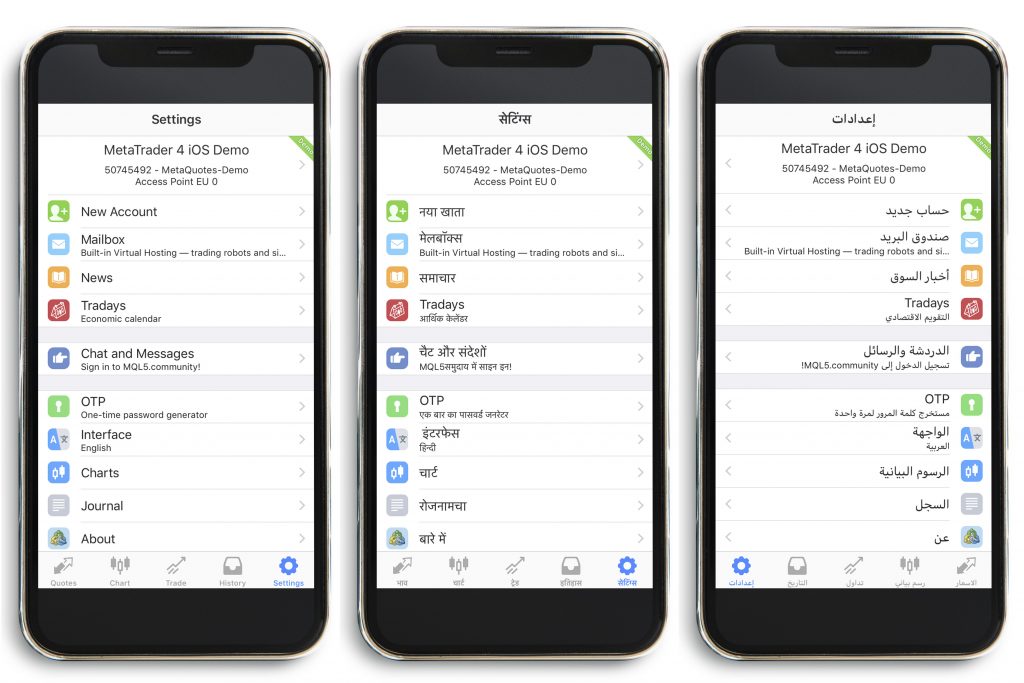

The images below showcase the trading screen in multiple languages on the MetaTrader 4 (MT4) trading platform for iOS.

Charting & Statistical Indicators/Studies

Charts and indicators are used extensively by traders across the world and help them decide on taking a position by forecasting the price movement of an asset, especially in short term trades and intraday trading of securities. Traders ideally like the charts to come with different chart styles – line, bar, candlesticks, etc.

As for indicator studies, the more, the merrier, since the choice of indicators that traders use on a chart is according to their needs and what they are used to. A typical trading screen combines the watchlist, open positions, and chart-view as per the trader’s preference. A sample is showcased below, in the introductory video for Denmark based Saxo Bank’s global trading platform SaxoTrader GO which is offered in 20 languages.

Market Updates / Newsfeed

Information is the key to successful trading, and traders are forever in pursuit of seeking information that might give them an edge on the positions they plan to take or may have already taken. A good platform, therefore, must have a timely market newsfeed and updates for its clients, which is further augmented if the users can access that information in their preferred language for a quicker grasp. That can only be achieved if the translation is done right and by a subject matter expert.

Transaction, Regulatory, Fund Transfer Notifications & Updates

Various push notifications are sent to traders, some of which a broker might need to send as a regulatory requirement. All transactions entered into are recorded, and emails, as well as text messages, are sent to the client daily. Margin calls on leveraged trades are important notifications from a regulatory as well as risk point of view.

Other notifications like those for fund transfers between the trading account and a client’s banking account as well as contract notes for trades, etc., are also a regular feature. These need to be customised as per the requirements laid down by the country-specific capital market regulator and in the preferred language for the clients.

Event Calendar

These are calendars representing various events like financial results, corporate actions like cash dividends, stock splits, and stock dividends or bonus ex-dates, macro-economic data releases like inflation data, PMI data, employment data, GDP numbers, etc. as well as other events that may affect the capital markets and specific asset prices. This information is highly local and differs from one country to another.

Some events are isolated and specific to only one country, while others may have a more global effect. These are vital for traders to follow, and developments like these have the potential to create volatility in the capital markets. An event calendar is probably the best advocate for brokers to localise specific to a country.

Customer Service

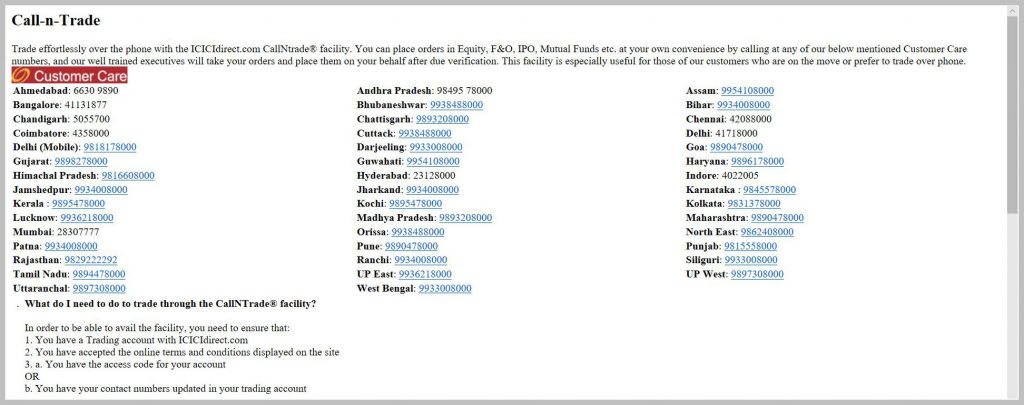

The backbone of any successful product or service is how well-treated the customers feel, not only when they come looking for help or with a grievance, but also how the provider communicates with them in general across different platforms.

A lot of firms these days build a formidable knowledge base that includes FAQs, articles, manuals, and videos, which try to answer the most commonly raised queries and also help the customer understand how best to use the product or service.

As a second line of service, the customer can call an executive to resolve an issue. In each instance, it is undoubtedly clear that if the provider can speak with the customer in a language that he or she is most comfortable in, the results are far more positive. Keeping the language simple and clear is the key to easy understanding.

Another aspect in the case of brokers is the call and trade service that some of them offer. Here, a customer calls an executive and gives the instruction to carry out the trade on his behalf. In this case, efficient customer service plays a pivotal role in generating business and adding volumes.

Concluding Thoughts

While these examples from well-known global online brokers and trading platform providers are not exhaustive, they certainly are more than adequate in showcasing how they have taken advantage by localising their offerings to cater to clients across geographies and cultures. It has enabled them to gain acceptance among a much wider audience, thereby pushing up their trade volumes as compared to competitors. Additionally, they’ve established a strong brand recollect in overseas markets.

As we conclude, we hope you stay tuned for the final article of this series!